The Best Ways to Improve Your Credit Score

Understanding Your Credit Score

Understanding your credit score is crucial for managing your financial health effectively. A good credit score can impact your ability to secure loans, favorable interest rates, and even influence renting a house or your job prospects. Here’s an essential guide to what a credit score is, why it matters, and how you can effectively manage it.

Explanation of What a Credit Score Is and Why It Matters

A credit score is a numerical representation of your creditworthiness, which lenders use to evaluate the risk of lending you money. It reflects your financial history and helps creditors assess how likely you are to repay your debts. Credit scores can affect the interest rates you are offered on loans and credit cards, your insurance premiums, rental requests, and sometimes even your job applications.

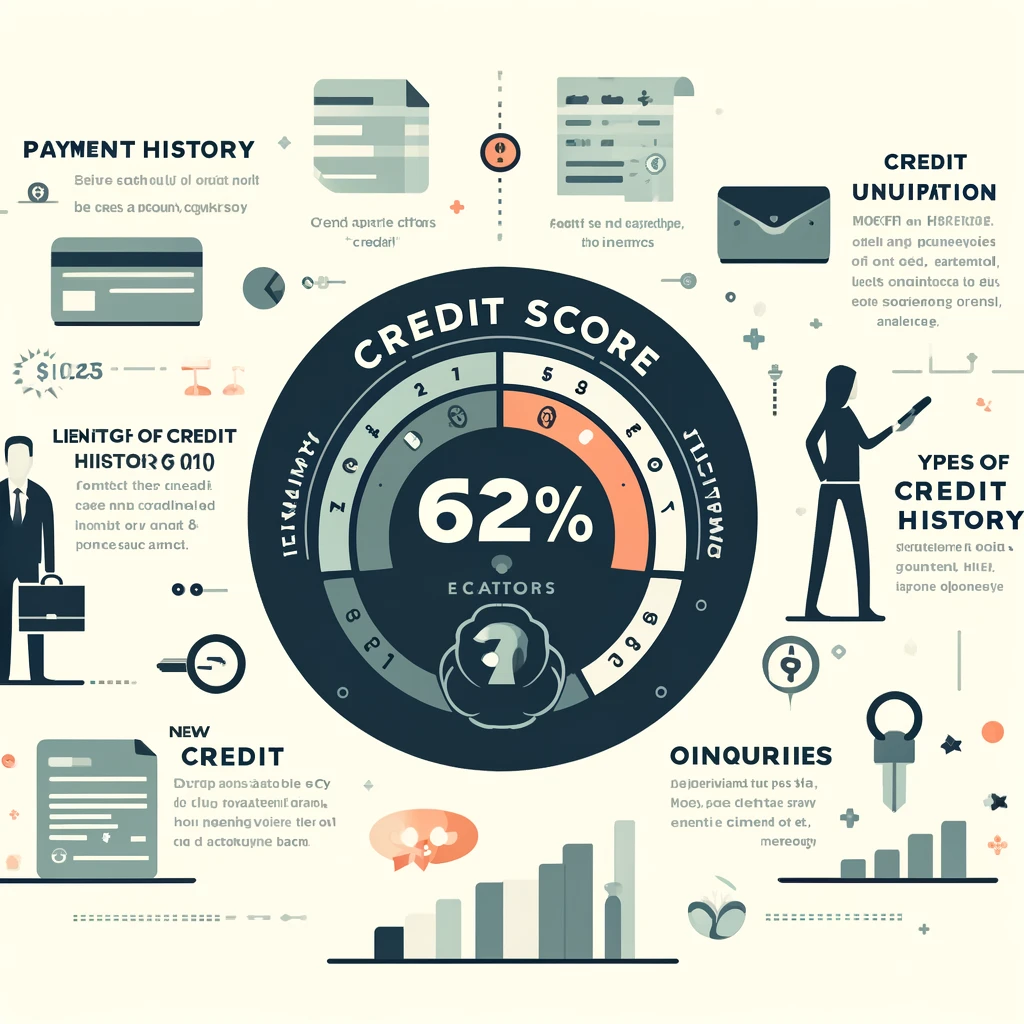

The Factors That Affect Your Credit Score

- Payment History (35%): Your record of paying debts on time is the most significant factor. Late payments, bankruptcies, and defaults will negatively affect your score.

- Credit Utilization (30%): This is the ratio of your current revolving credit (like credit card balances) to the total available revolving credit (credit limits). Keeping this ratio below 30% is ideal.

- Length of Credit History (15%): Longer credit histories are generally beneficial because they provide more data for lenders to evaluate.

- Types of Credit in Use (10%): Having a mix of different types of credit (such as installment loans, credit cards, and mortgages) can positively affect your score.

- New Credit (10%): Opening several new credit accounts in a short period can be seen as risky by lenders and might temporarily lower your score.

How to Obtain and Read Your Credit Report

You are entitled to a free credit report from each of the three major credit reporting agencies — Equifax, Experian, and TransUnion — once every 12 months via AnnualCreditReport.com. Reviewing your credit report is essential to understand your credit status and to check for any inaccuracies:

- Identify Errors: Look for inaccuracies such as wrong addresses, misspelled names, incorrect account details, or fraudulent accounts.

- Dispute Errors: Contact the credit bureau and the provider who reported the information to dispute any errors you find.

Recognizing the Difference Between FICO and Other Credit Scores

- FICO Scores: The most commonly used credit score in lending decisions. FICO scores range from 300 to 850, with scores above 670 considered good.

- VantageScore: Developed by the three major credit bureaus as an alternative to FICO, VantageScore also ranges from 300 to 850 but calculates scores slightly differently.

Common Misconceptions About Credit Scores

- Checking Your Own Score Lowers It: Checking your own credit score is considered a “soft inquiry” and does not affect your score.

- Your Income Affects Your Credit Score: Your income doesn’t directly impact your credit score, although it can influence your ability to borrow and your credit utilization.

- Closing Old Accounts Boosts Your Score: Closing old accounts can actually lower your score by affecting your credit utilization and the average age of your credit accounts.

- You Only Have One Credit Score: You have multiple credit scores. Different lenders might use different scores, and the same lender might use different scores for different types of loans.

Check Your Credit Report for Errors

Regularly checking your credit report is crucial for maintaining a healthy financial profile and ensuring the accuracy of the information that creditors and lenders see. Here’s a guide on how to access your credit report, identify errors, dispute inaccuracies, and understand the importance of regular monitoring.

How to Access Your Free Annual Credit Report

You are entitled to a free annual credit report from each of the three major credit reporting agencies—Equifax, Experian, and TransUnion. Follow these steps to access your report:

- Visit AnnualCreditReport.com: This is the only federally authorized website that offers free credit reports as mandated by law.

- Provide Your Information: You’ll need to provide your name, address, Social Security number, and date of birth to verify your identity.

- Select the Reports: You can request reports from all three bureaus at once, or stagger your requests to monitor your credit throughout the year.

- Review Your Reports: Download or print your reports for review.

Identifying Errors in Your Credit Report

When reviewing your credit report, look for common errors that can negatively impact your credit score:

- Incorrect Personal Information: Errors in your name, address, or Social Security number.

- Account-Related Errors: Accounts that don’t belong to you, incorrect account statuses, or wrong dates.

- Balance Errors: Mistakes in account balances or credit limits.

- Duplicate Accounts: Accounts that appear more than once with different creditors listed.

The Process for Disputing Errors with Credit Bureaus

If you find an error on your credit report, take the following steps to dispute it:

- Document the Error: Identify what information you believe is incorrect and gather any documents that support your claim.

- Contact the Credit Bureau: File a dispute online or by mail. Clearly explain the error and include copies (not originals) of any supporting documentation. The Federal Trade Commission provides a sample dispute letter for this purpose.

- Notify the Information Provider: Contact the creditor or company that provided the incorrect information to the credit bureau. Inform them of the dispute and provide supporting evidence.

- Follow-up: Credit bureaus typically investigate disputes within 30 days. They must inform you of the results and provide a free updated report if the dispute results in a change.

The Importance of Regularly Monitoring Your Credit Report

Regular monitoring can help you:

- Catch Errors Quickly: The sooner you identify and address errors, the less impact they will have on your credit applications.

- Detect Identity Theft: Spotting accounts or activities you don’t recognize can be an early warning of identity theft.

- Understand Credit Health: Regular reviews keep you informed about your credit status and help you make better financial decisions.

How Small Errors Can Have a Big Impact on Your Score

Even minor discrepancies, like a wrongly reported late payment or a small debt that doesn’t belong to you, can significantly lower your credit score. This can affect your ability to obtain loans, secure housing, or even impact job prospects in fields that check credit scores as part of the hiring process.

Pay Bills on Time: Strategies for Ensuring Timely Payments

Paying your bills on time is one of the most effective ways to maintain or improve your credit score. Timely bill payments show lenders that you are a responsible borrower. Here’s how you can ensure on-time payments, understand their impact on your credit score, and manage any issues with past due accounts.

Strategies for Ensuring Timely Payments

Setting Up Automated Payments or Reminders

- Automated Payments: Many financial institutions offer automatic bill pay services, where the amount owed is automatically deducted from your bank account on a specified date. This is particularly useful for consistent payments like mortgages, car loans, or insurance premiums.

- Calendar Reminders: Utilize digital calendars to set reminders a few days before your bills are due. This gives you a buffer to ensure funds are available and payments are not missed.

- Bill Pay Apps: Use apps that consolidate all your bills in one place and send you alerts when payments are due. Apps like Mint or Prism can help you manage your bills more effectively.

How Payment History Influences Your Credit Score

- Significant Impact: Payment history accounts for approximately 35% of your FICO credit score, making it the most critical factor in credit scoring.

- Recording of Late Payments: Payments reported as late (typically after being 30 days past due) can significantly damage your credit score. The later the payment, the more severe the impact.

- Recovery from Late Payments: While late payments affect your score negatively, consistent on-time payments afterwards can help gradually repair the damage.

Dealing with Past Due Accounts

- Catch Up Quickly: If you miss a payment, try to make it as soon as possible. Payments less than 30 days late might not even be reported to the credit bureaus if you act quickly.

- Communicate with Creditors: If you know you’ll miss a payment, contact your creditor. Many are willing to work with you to set up payment plans or temporary forbearance.

- Consolidate or Refinance: If multiple due dates are confusing, consider consolidating debts or refinancing to have fewer payments to manage.

The Consequences of Late Payments

Credit Score Drop: Even one late payment can cause a significant drop in your credit score, particularly if your score was high to begin with.

Increased Interest Rates: Some creditors might increase your interest rates after a late payment, which can increase the overall cost of borrowing.

Late Fees: Most missed payments come with late fees, adding to your debt.

Potential for Default: Continual late payments can lead to account default or collections, severely impacting your credit and making it difficult to obtain new credit.

- Pay Down Balances: Make payments above the minimum due to reduce your total outstanding balance faster. Prioritize paying off cards that are closest to their limits.

- Increase Credit Limits: Request a credit limit increase from your card issuers. If approved, this can instantly lower your utilization ratio. However, this should only be done if you will not increase your spending habits.

- Spread Charges Across Multiple Cards: Distribute your spending across several cards to keep the utilization on any single card lower.

The Importance of Keeping Balances Low on Credit Cards

- Improves Credit Score: Lower balances relative to your credit limits (credit utilization ratio) favorably impact your credit score. Aim to keep your utilization under 30%, and ideally under 10%.

- Less Interest to Pay: Lower balances mean less money spent on interest, which can save you significant amounts of money over time.

- Financial Flexibility: Less debt gives you more breathing room in your budget for other financial goals and emergencies.

Tips for Paying Off High-Interest Debt First

- Avalanche Method: Focus on paying off the debts with the highest interest rates first while maintaining minimum payments on others. This method saves you the most money on interest over time.

- Prioritize Expensive Debts: Credit cards often carry higher interest rates than other debts, so they should typically be prioritized unless other loans have similar or higher rates.

How Consolidating Debt Can Affect Your Credit Score

- Short-Term Impact: Initially, applying for a new consolidation loan might lower your score slightly due to the hard inquiry from your application.

- Long-Term Benefits: Consolidating multiple debts into a single loan can simplify your payments and potentially lower your interest rates. As you pay down the new loan, you could see your credit score improve due to lower utilization and consistent, on-time payments.

- Choose Wisely: Ensure the consolidation loan offers a lower interest rate and manageable terms. Sometimes, the fees involved in consolidation may not justify the restructuring.

Techniques for Avoiding New Debt

- Budget Strictly: Keep a detailed budget that tracks all your spending. Avoid expenses that aren’t necessary and allocate funds towards saving.

- Emergency Fund: Build and maintain an emergency fund to cover unexpected expenses instead of relying on credit cards.

- Use Cash or Debit: Using cash or a debit card for everyday purchases can help prevent new debt from accumulating.

- Credit Freezes: Consider putting a freeze on your credit if you’re tempted to open new credit accounts. This prevents you from opening new lines of credit until you lift the freeze.

Increase Credit Limits Responsibly

Increasing your credit limit can be a beneficial strategy to improve your financial flexibility and credit score. However, it needs to be done carefully and responsibly to avoid potential pitfalls. Here’s how you can effectively manage a credit limit increase.

When and How to Request a Credit Limit Increase

- Timing: Consider requesting an increase after a period of consistent on-time payments, or after an improvement in your income. Typically, having a good track record with the lender for at least six months to a year is advisable.

- How to Request: You can request an increase either online through your account management portal or by calling customer service. Be prepared to provide information about your current income and possibly your employment details.

The Potential Benefits and Risks of Higher Credit Limits

Benefits

- Lower Credit Utilization Ratio: Increasing your credit limit while keeping balances low can decrease your credit utilization ratio, which may improve your credit score.

- Enhanced Purchasing Power: A higher credit limit offers more flexibility in case of emergencies or necessary large purchases.

Risks

- Overspending: With greater credit available, there might be a temptation to spend more, which can lead to increased debt.

- Potential for Higher Debt: If not managed well, higher limits can lead to unmanageable debt levels, especially if financial circumstances change unexpectedly.

How Credit Limit Increases Affect Your Utilization Ratio

- An increase in your credit limit, without an increase in your balance, will decrease your overall credit utilization ratio. For example, if you owe $2,000 on a card with a $4,000 limit, your utilization is 50%. If the limit is increased to $6,000 and you do not increase your debt, your utilization drops to about 33%, which is more favorable for your credit score.

Guidelines for Using Increased Credit Wisely

- Maintain Low Balances: Even with higher limits, aim to keep your balances low relative to your new credit limit to benefit your credit score.

- Emergency Use Only: Consider using the additional credit only for emergencies or planned, necessary expenditures that you know you can pay off.

- Regular Monitoring: Keep an eye on your spending habits to ensure you don’t gradually increase your debt without realizing it.

The Importance of Not Overextending Financially

- Financial Discipline: The key to benefiting from increased credit limits is maintaining strict financial discipline. This means not spending more than you can afford to pay back within a reasonable period.

- Debt Management: Avoid using the additional credit as a means to extend your debt repayment periods. Use the increased limit to your advantage, not as a way to accumulate more debt.

Keep Old Accounts Open: Maximizing Your Credit Score

Understanding the dynamics of credit history and the impacts of account management can significantly influence your credit score. Keeping old accounts open is a strategy that can benefit your credit health over time. Here’s an overview of why maintaining old credit accounts is advantageous, the potential risks of closing them, and how to manage old accounts responsibly.

The Benefits of a Long Credit History

- Credit Age Contribution: The length of your credit history contributes approximately 15% to your FICO score. Older credit accounts increase the average age of your accounts, which credit scoring models view favorably.

- Demonstration of Creditworthiness: A longer credit history provides potential lenders with more data, demonstrating your ability to manage credit over extended periods.

Why You Should Consider Keeping Unused Credit Accounts Open

- Credit Utilization Ratio: Keeping older accounts open, especially those with higher credit limits and zero or low balances, can help lower your overall credit utilization ratio (the amount of credit you are using compared to the credit available to you). This ratio significantly affects your credit score, with lower utilization generally leading to a higher score.

- Financial Flexibility: Open accounts with zero balances increase your available credit, offering more flexibility in cases of financial emergencies or unforeseen expenses.

How Closing Accounts Can Impact Your Credit Score

- Increased Utilization Ratio: Closing an account decreases your overall available credit, which can increase your credit utilization ratio if you carry balances on other cards.

- Loss of Credit Diversity: Credit mix—having various types of credit accounts—is another factor in your credit score. Closing an account might reduce this mix, potentially lowering your score.

- Impact on Credit Age: Closing older accounts can decrease the average age of your open accounts, negatively affecting your score over time.

The Effect of Account Age on Your Credit History

- Stability and Reliability: Older accounts show stability and long-term reliability, which are positive indicators to lenders.

- Gradual Impact: The positive impact of older accounts grows as they age. Keeping these accounts open, even if you don’t use them frequently, continues to benefit your credit score.

Managing Old Accounts Responsibly

- Monitor for Fraud: Keep an eye on old accounts for any unauthorized use or fraudulent activities. Set up alerts or check statements regularly to ensure there are no unauthorized transactions.

- Active Status: Some issuers might close accounts due to inactivity. To prevent this, consider using older accounts for small purchases periodically, then paying off the balance immediately.

- Avoid Fees: If an old account has high fees, weigh the cost against the potential credit score benefits. If the fees are burdensome, consider whether it might be better to close the account, especially if you have other old accounts with no fees.

Mix Your Credit Types: Enhancing Creditworthiness

A diverse mix of credit types can positively impact your credit score and demonstrate your ability to manage different forms of credit responsibly. Understanding how to balance and diversify your credit portfolio is crucial for building and maintaining strong credit health. Here’s why having a variety of credit accounts is beneficial and how to strategically manage your credit types.

The Benefits of Having a Mix of Credit Accounts

- Credit Score Improvement: Credit scoring models, like FICO, consider the types of credit you manage. Having a mix—such as credit cards, installment loans, mortgages, and store accounts—can positively affect your score.

- Demonstration of Credit Management Skills: Successfully managing multiple types of credit demonstrates to lenders that you can handle various financial responsibilities, which can make you more appealing to potential lenders.

How Different Types of Credit Reflect on Your Creditworthiness

- Revolving Credit (Credit Cards): Shows how you manage your spending and payments when the balance and payments can vary month to month.

- Installment Credit (Loans): Indicates your reliability in making consistent payments over time on set amounts, which is crucial for big-ticket loans like mortgages.

- Open Credit (Utility Bills): Although less commonly reported to credit bureaus, paying these consistently can also positively influence your credit score if they are reported.

Strategies for Adding Variety to Your Credit Portfolio

- Start with What You Need: Only apply for new credit if you genuinely need it or if it makes financial sense—not just to add variety to your credit mix.

- Secure a Mix of Credit Types: If you only have credit cards, consider a small personal or auto loan if you need to make a purchase that allows for installment payments.

- Use Retail Accounts Wisely: Opening a retail store credit card can be beneficial if you regularly shop there and the card offers significant discounts, but be sure to pay the balance in full to avoid high interest rates.

The Risks and Benefits of Diversifying Your Credit Types

Risks

- Potential for High Debt: Obtaining various types of credit can lead to high levels of debt if not carefully managed.

- Hard Inquiries: Applying for several new types of credit can result in multiple hard inquiries, which might temporarily lower your credit score.

Benefits

- Improved Risk Assessment by Lenders: A diversified credit portfolio can lower your risk profile and potentially lead to better loan offers and interest rates.

- Resilience: Different types of credit can provide financial flexibility, reducing dependency on a single credit source.

Understanding Which Types of Credit You Really Need

- Assess Your Financial Goals: Choose credit types that align with your long-term financial objectives. For example, a mortgage might be necessary if you’re looking to buy a home.

- Consider Your Financial Stability: Ensure that you can comfortably manage the repayments of any new credit you take on without overstressing your financial situation.

- Plan for Future Needs: If you plan to make a significant purchase, like a car or home, starting with smaller credit types like credit cards or small personal loans can help build your creditworthiness.

Limit New Credit Inquiries

When you apply for credit, lenders perform credit inquiries to evaluate your creditworthiness, which can impact your credit score. Understanding the difference between soft and hard inquiries, and managing them wisely, can help you maintain a healthier credit score. Here’s a detailed look at how credit inquiries affect your score and strategies to minimize their impact.

How Hard Inquiries Affect Your Credit Score

- Temporary Impact: Hard inquiries can lower your credit score by a few points. While the impact is usually small, multiple inquiries in a short period can add up.

- Duration: Hard inquiries remain on your credit report for two years, but their impact on your credit score diminishes over time, typically ceasing to affect your score after one year.

The Impact of Shopping for New Credit

- Risk Signal: Multiple hard inquiries in a short time can signal to lenders that you are a higher risk, potentially leading to higher interest rates or denial of credit.

- Loan Shopping Exception: For certain types of loans, such as auto loans, student loans, and mortgages, credit scoring models allow for rate shopping. All inquiries made within a short period (typically 14-45 days, depending on the scoring model) are treated as a single inquiry.

Deciding When to Apply for New Credit

- Necessity Over Desire: Apply for new credit only when necessary (e.g., buying a car or home), rather than for discretionary spending.

- Financial Readiness: Ensure you are financially stable enough to handle new credit. Consider your employment stability, current debt levels, and your ability to repay.

- Credit Score Status: If your credit score is on the boundary between scoring categories, it may be wise to avoid new inquiries until your score has improved.

Soft vs. Hard Inquiries: What You Need to Know

- Soft Inquiries: These do not affect your credit score and occur when you check your own credit or when a lender checks your credit for pre-approval offers. Examples include checking your own score, employment verification, or pre-approved credit offers.

- Hard Inquiries: These occur when a financial institution checks your credit as part of a lending decision, like when you apply for a loan, credit card, or mortgage. Hard inquiries can affect your score because they imply you’re seeking new credit.

Strategies to Minimize Unnecessary Hard Inquiries

- Pre-Qualification: Before officially applying for credit, ask if you can be pre-qualified, which only involves a soft inquiry.

- Limit Applications: Only apply for credit when absolutely necessary and avoid multiple credit card applications within a short period.

- Understand Lender Requirements: Research credit requirements beforehand to ensure you are a good candidate, which can reduce the likelihood of denial and the need for multiple applications.

- Consolidate Applications: If planning significant purchases like a car or home, try to consolidate related credit applications within a short window to take advantage of rate shopping exceptions.

Build Credit with a Secured Credit Card

Secured credit cards are a valuable tool for building or rebuilding credit. Understanding how they work, how to choose the right one, and how to manage them effectively can set you on a path to improved financial health. Here’s a detailed guide on utilizing secured credit cards to your advantage.

What Is a Secured Credit Card and How It Works

- Definition: A secured credit card requires a cash deposit that serves as collateral and typically sets the credit limit for the account. This deposit reduces the risk for the issuer, making these cards more accessible to individuals with poor or limited credit history.

- Functionality: Just like a regular credit card, you can use a secured card to make purchases up to a set credit limit and you are required to make payments on any balance owed each month. Payments on secured cards are reported to credit bureaus, affecting your credit just as a standard credit card would.

Choosing the Best Secured Card for Your Needs

- Low Fees: Look for cards with low annual fees or no maintenance fees. Some cards also offer the chance to earn interest on your deposit.

- Reporting to All Major Credit Bureaus: Ensure the card issuer reports to all three major credit bureaus (Experian, TransUnion, and Equifax) to maximize the impact on your credit score.

- Upgrade Options: Some secured cards allow you to transition to an unsecured card after a period of responsible usage, which can be beneficial for your credit health.

- Interest Rates: While you should plan to pay the card in full each month to avoid interest, compare the APRs on cards if you think you might carry a balance.

How to Transition from a Secured Card to a Regular Card

- Review the Card’s Policy: Understand the specific criteria your card issuer has for transitioning to an unsecured card. This often involves a history of on-time payments and responsible credit use.

- Monitor Your Credit Score: As your score improves, you may become eligible for a standard credit card. Regularly check your credit score to see when it might be time to upgrade.

- Contact Your Issuer: If you’ve used your card responsibly, reach out to your issuer about upgrading to an unsecured card. Some issuers may review your account automatically and offer an upgrade.

The Role of Secured Cards in Building or Rebuilding Credit

- Positive Reporting: Regular, on-time payments will be reported to credit bureaus, which can help build or rebuild your credit profile.

- Credit Utilization: Keep your balance low in comparison to the credit limit to improve your credit utilization rate, a key factor in your credit score.

- Foundation for Credit: For those with limited or damaged credit, a secured card is often the first step toward qualifying for more substantial loans, like auto loans or mortgages.

Managing a Secured Card Effectively

- Payment Discipline: Always pay your bill on time. Set up reminders or automatic payments to ensure you never miss a payment.

- Low Utilization: Try to use less than 30% of your available credit. Even lower utilization can be beneficial for your credit score.

- Regular Review: Check your credit card statement and credit report regularly to ensure accuracy and to understand how your credit usage impacts your score.

- Responsible Use: Treat your secured card as a stepping stone. Use it for small, regular purchases that you can afford to pay off each month to avoid falling into debt.

Seek Professional Help If Needed: Navigating Credit Counseling and Debt Management

If you’re struggling with debt or have concerns about your credit, professional help from credit counselors can be invaluable. Understanding when to seek help, how to find reputable services, and the differences between credit counseling and credit repair are crucial steps in effectively managing your financial health.

When to Consider Credit Counseling

Consider seeking credit counseling if you:

- Feel Overwhelmed by Debt: If you’re struggling to manage your debt load or to make minimum payments, a credit counselor can help you work out a plan.

- Have Questions About Credit: If you’re unsure how credit works or how to improve your credit score.

- Need Help Budgeting: Credit counselors can also assist in creating a manageable budget based on your income and expenses.

Finding Reputable Credit Counseling and Debt Management Programs

- Certification and Accreditation: Look for agencies that are accredited by national organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

- Transparency: Reputable agencies will be transparent about their fees and services. Avoid organizations that request substantial fees upfront or guarantee quick fixes.

- Check Reviews and Complaints: Check with the Better Business Bureau and online reviews for feedback about the agency. Also, review any complaints filed with your state attorney general’s office or the Consumer Financial Protection Bureau (CFPB).

How Credit Counseling Can Help You Manage Debt and Improve Scores

- Debt Management Plans (DMPs): Credit counselors can help set up DMPs where you make a single payment to the counseling agency, which then distributes payments to your creditors. Often, they can negotiate lower interest rates and waived fees.

- Financial Education: Counseling services often include workshops and one-on-one sessions on budgeting, using credit wisely, and saving for the future.

- Avoiding Bankruptcy: By managing debt through a DMP, you may avoid more drastic measures like bankruptcy, which can severely impact your credit score.

The Difference Between Credit Counseling and Credit Repair

- Credit Counseling: Offers a holistic approach to debt management and financial education. Counselors work with you to create a budget and can manage debt through DMPs. This service aims to educate and assist consumers in managing their debt and improving their financial situations over time.

- Credit Repair: Focuses primarily on disputing inaccuracies on your credit reports to improve your score. This process involves identifying errors or outdated information on your credit report and formally disputing them with credit bureaus.

Legal Considerations and Consumer Rights in Credit Repair

- Fair Credit Reporting Act (FCRA): Ensures your right to an accurate credit report and entitles you to dispute incorrect information.

- Credit Repair Organizations Act (CROA): Prohibits credit repair companies from misleading consumers about their services and charges, and from demanding advance payment.

- Right to Cancel: Under CROA, you have the right to cancel a contract with a credit repair organization within three days without any charge.

Frequently Asked Questions for “The Best Ways to Improve Your Credit Score”

1- What is a credit score?

A credit score is a numerical representation of your creditworthiness based on your financial history. It’s used by lenders to evaluate the risk of lending you money and influences your eligibility for loans, credit card approvals, and interest rates.

2- What factors affect my credit score?

Your credit score is influenced by payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries.

3- How can I check my credit report?

You can obtain a free annual credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) via AnnualCreditReport.com. It’s important to review your credit report regularly to ensure accuracy and to identify any discrepancies.

4- How do I improve my credit score?

Improve your credit score by paying bills on time, reducing debt levels, avoiding new credit applications, maintaining a mix of credit types, and keeping old credit accounts open.

5- What is the impact of credit inquiries on my score?

Hard inquiries, which occur when lenders check your credit during the lending decision process, can slightly lower your credit score. However, checking your own credit score results in a soft inquiry, which does not affect your score.

6- Can closing old credit accounts affect my credit score?

Yes, closing old credit accounts can negatively impact your credit score by reducing the average age of your accounts and increasing your credit utilization ratio.

7- What should I do if I find errors on my credit report?

If you find errors on your credit report, dispute them with the credit bureau and the provider who reported the information. This can help to remove inaccuracies and potentially improve your credit score.

8- How can I manage my credit cards effectively to boost my credit score?

Keep balances low, pay off your balance each month to avoid interest charges, and use your cards responsibly. It’s also beneficial to have a mix of credit cards and installment loans to show that you can handle different types of credit.

9- What are some strategies for paying down high-interest debt?

Use the avalanche method, where you pay off debts with the highest interest rates first, or the snowball method, where you pay off smaller debts first to build momentum.

10- How can I avoid damaging my credit score?

Avoid late payments, minimize hard credit inquiries, and do not take on more debt than you can manage. Regular monitoring of your credit report can also help you catch and address potential issues early.

References and Links:

- AnnualCreditReport.com – Official Site for Free Credit Reports

- Federal Trade Commission – Consumer Information on Credit Scores

- Experian – Understanding Your Credit Score

- MyFICO – What’s in My FICO Scores?

- Consumer Financial Protection Bureau – How to Dispute an Error on Your Credit Report

- Equifax – How to Improve Your Credit Score

- NerdWallet – How to Build Credit

- Credit Karma – Guide to Credit Scores

- The Balance – How Credit Scores Work and What They Say About You

- National Foundation for Credit Counseling – Credit Counselor Services